How to Ensure That You Do Not Get An Income Tax Notice?

What is an Income Tax Notice?

An income tax notice is an official letter from the Income Tax Department. It tells you that something in your tax return needs your attention. This could be an error, missing information, or a mismatch in income details. Sometimes, it's just a routine check. The notice will clearly mention what the issue is and what you need to do next. This may include submitting documents, paying pending tax, or making corrections. These notices are usually sent to your registered email and are also available on the Income Tax e-Filing Portal.

When is an Income Tax Notice Issued?

You may receive an income tax notice for different reasons. It doesn’t always mean you’ve done something wrong—it could also be part of a routine check. Common reasons include:

- Mismatch between the filed return and data in Form 26AS or AIS

- Errors in the return, such as missing information or use of an incorrect form

- Late filing or non-filing of the return

- Unreported high-value transactions, including large cash deposits or investments

- Excess or insufficient tax payment

- Selection of the return for detailed scrutiny

- Reassessment of earlier returns where income may have been omitted

Types of Income Tax Notices in India

Many types of notices are sent under different sections of the Income Tax Act. Each one has a specific purpose. Here are the most common types:

Section 143(1): Intimation after return processing—may show refund, tax due, or no change.

Section 143(2): Issued for scrutiny if the return is selected for detailed review.

- Section 142(1): Requests additional documents or information before assessment.

- Section 139(9): Notifies of a defective return needing correction.

- Section 148: Sent when income is believed to have escaped earlier assessment.

- Section 156: Demand notice for tax, interest, or penalty payable.

- Section 131: Summons for appearance or submission of records during inquiry.

Always read the notice carefully and act on it before the deadline.

Here are some points to ensure that you do not get an income tax notice

- If you claim an excess income tax credit in your income tax return (ITR), it could trigger a notice from the income tax department. You can avoid it by ensuring your ITR is reconciled with Form 26AS.

- The last date to file your Income Tax Return (ITR) for FY23 (Assessment Year 2023-24) is July 31. Those filing ITRs after the due date will have to pay interest and a penalty, as applicable.

- Navigating the tax filing process can feel tiring or cumbersome. But don't worry! There's a master key, rather a master document, that can help you complete this process - Form 26AS/AIS.

- This document is like a tax passbook that records all your tax-related transactions, making it an indispensable tool for filing your Income Tax Return.

What is Form 26AS/AIS?

Form 26AS/AIS is a consolidated statement that records all tax-related information against your Permanent Account Number (PAN).

It's like a financial diary that keeps track of your tax credits, tax deducted at source (TDS), tax collected at source (TCS), and other tax payments. It also includes information regarding high-value transactions, tax refunds and pending tax demands.

Information Available on Form 26AS

Form 26AS is a consolidated tax statement linked to your PAN that shows all tax-related details for a financial year. It includes TDS, TCS, advance tax, self-assessment tax, and refunds issued. It also reports high-value transactions like property purchases, mutual funds, and interest income, even without TDS if declarations like Form 15G/15H are submitted. Reviewing Form 26AS helps ensure that taxes deducted on your behalf are correctly deposited and recorded. It reduces errors while filing returns, helps claim refunds, and lowers the chance of receiving notices due to mismatches or unreported transactions.

Why is Form 26AS/AIS Important For ITR Filing?

Form 26AS/AIS plays a pivotal role in the ITR filing process for several reasons:

1. It provides a consolidated record of all your tax-related transactions, making it easier to file your ITR accurately.

2. It helps in verifying the TDS details mentioned in your ITR with the actual TDS deducted.

3. It aids in identifying any discrepancies or mismatches in your tax details, allowing you to rectify them before filing your ITR.

4. Salaried taxpayers must ensure that the income declared in Form 26AS matches the amount reported in Form 16, the certificate given by employers for TDS on salary.

Remember This

Most of us tend to look at Form 26AS only at the time of filing the ITR. Personal finance experts recommend that taxpayers regularly review the details mentioned in it.

Central to the review of the information contained in Form 26AS is recordkeeping.

Maintain all proof related to investments, deductions, big-ticket purchases and related bills.

How to Handle Mismatches in Form 26AS

As far as the Income Tax department is concerned, only Form 26AS will be accepted as an authentic document. In case of a discrepancy between the amount of TDS claimed in the ITR and the amount shown on Form 26AS, the Assessing Officer will consider only the amount shown on Form 26AS.

That is why you should always double-check Form 26AS before filing your ITR.

Discrepancies may occur because you failed to pay tax on some capital gains or because your employer deducted but did not deposit tax.

In any case, you must act quickly to correct the situation.

Downloading and verifying Form 26AS should be done well in advance of filing returns so that you have enough time to discuss any discrepancies with your employers or relevant parties.

Always check Form 16 or 16A against Form 26AS to catch mismatches early.

- If there’s a difference, ask your employer or deductor to correct their TDS return.

- If they don’t respond, raise a grievance on the TRACES portal or request rectification on the e-filing site.

Quick action helps avoid tax notices, refund delays, or penalties.

How To Find/Download Form 26AS From an e-filing Website?

The income tax website lists the following steps for you to access your Form 26AS

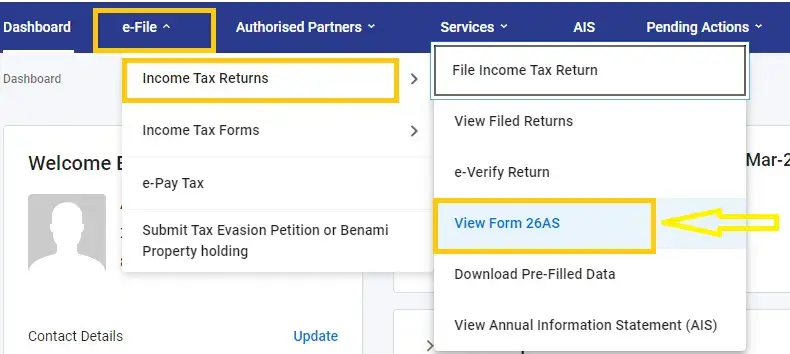

1. Log on to https://www.incometax.gov.in/iec/foportal/

2. Go to the 'My Account' menu, and click 'View Form 26AS (Tax Credit)' link.

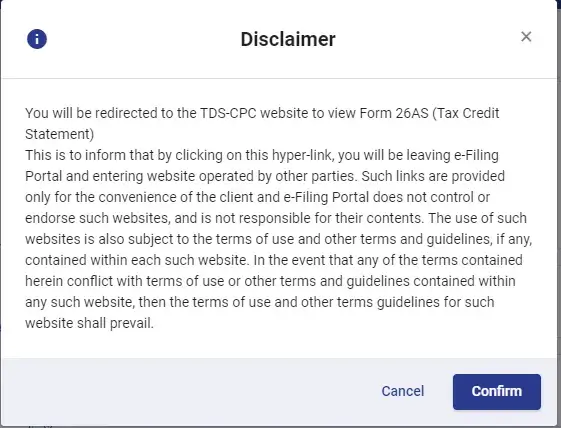

3. Read the disclaimer, click 'Confirm', and the user will be redirected to TDS-CPC Portal.

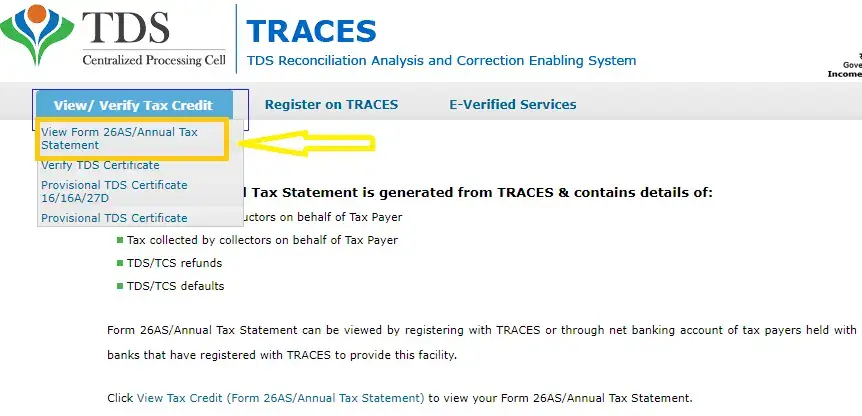

4. In the TDS-CPC Portal, Agree the acceptance of usage. Click 'Proceed'.

5. Click ‘View Tax Credit (Form 26AS)’

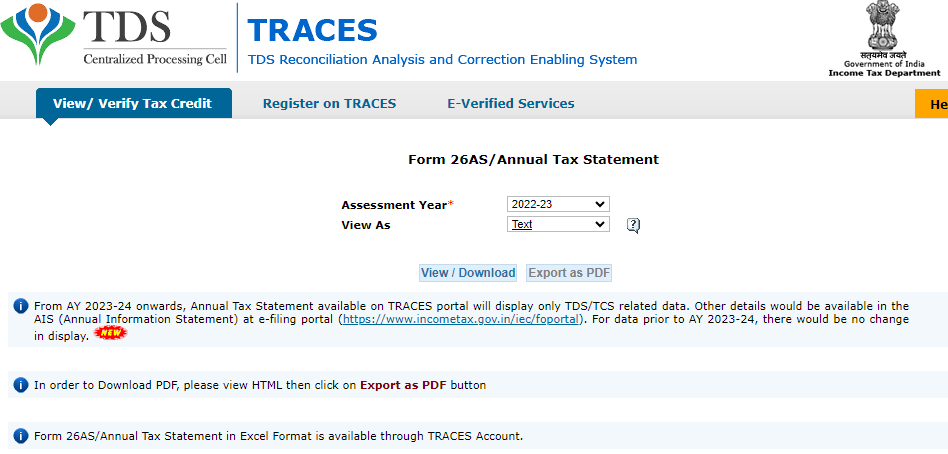

6. Select the ‘Assessment Year’ and ‘View type’ (HTML, Text or PDF)

7. Click ‘View / Download’

How to View Form 26AS Through Net Banking?

You can easily view your Form 26AS using your bank’s net banking facility. Just make sure your PAN is linked to your bank account and that your bank is authorised by the Income Tax Department.

Here’s how to do it:

- Log in to your bank’s internet banking portal

- Go to the ‘Tax’ or ‘Services’ section

- Click on ‘View Form 26AS’ or ‘Tax Credit Statement’

- You’ll be redirected to the TRACES website—no extra login needed

- Choose the assessment year and download your Form 26AS

This service is completely free and available to all PAN holders with eligible bank accounts.

Summing up

Form 26AS/AIS is not just a document; it's your key to a smooth and accurate ITR filing process.

It is the only document that the Income Tax department will refer to or form the basis of computing your tax liability.

Frequently Asked Questions

Q1.What’s New In The Revised Form 26AS/AIS?

The revised Form 26AS/AIS now includes additional information such as tax demands, specified financial transactions, payment of taxes, pending and completed proceedings, and other relevant details.

Q2.How Can Form 26AS/AIS Help In The ITR Filing Process?

Form 26AS/AIS is a comprehensive record of all your tax-related transactions. It helps in verifying the accuracy of the tax details mentioned in your ITR, identifying any discrepancies, and ensuring that your ITR filing is accurate and error-free.

Q3.How Can I Access My Form 26AS/AIS?

You can access your Form 26AS/AIS from the Income Tax Department's e-filing portal using your PAN.