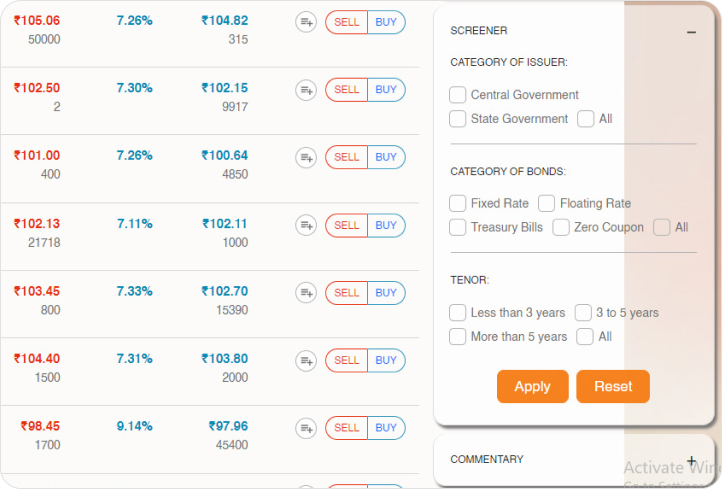

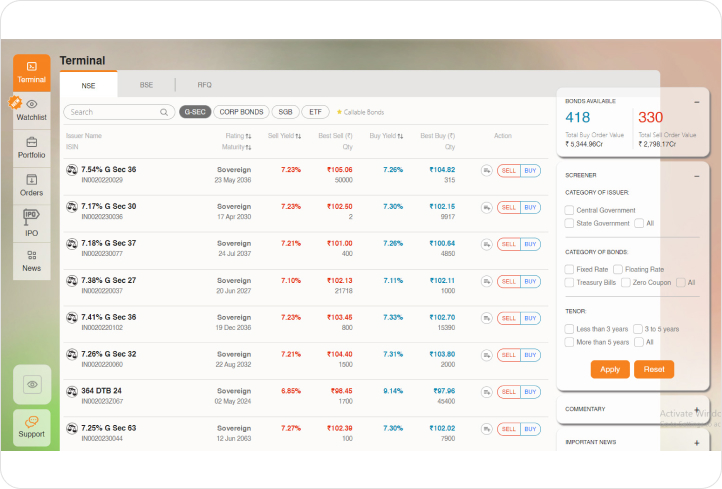

Discover Bonds

Select from wide range of bonds from High Yield to High

Search for any specific bond from G-Sec, Corp Bonds, SGB and more.

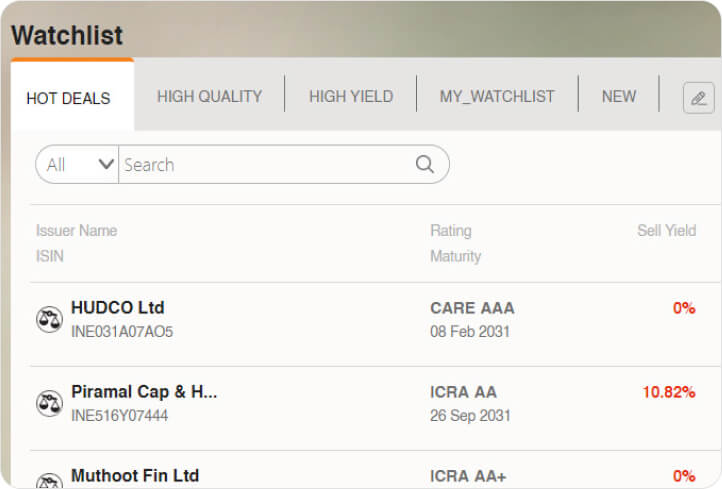

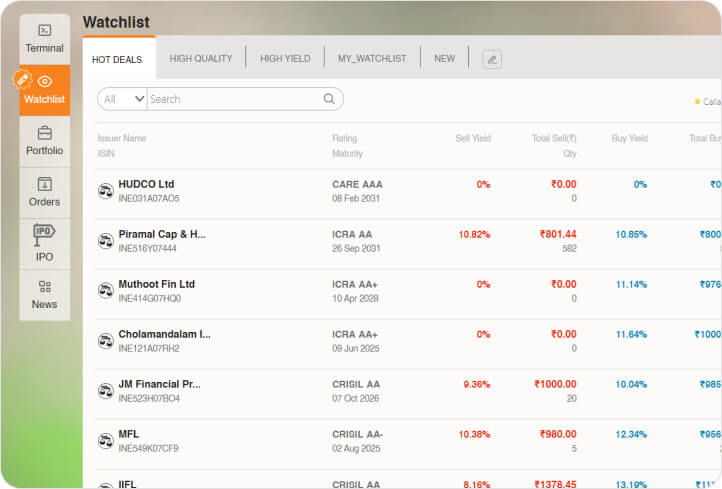

Watchlist

Keep Track of Bonds that you are interested in. The watchlist is designed for a focused user experience, presenting information for effortless navigation.

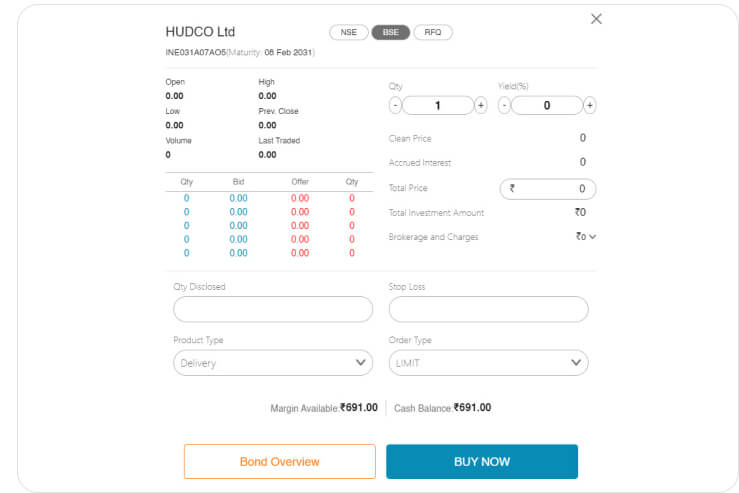

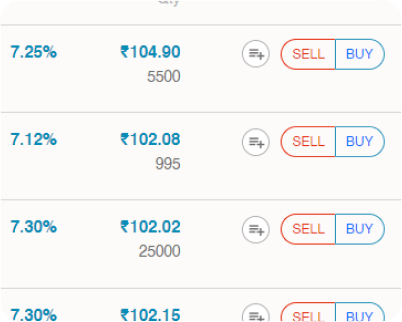

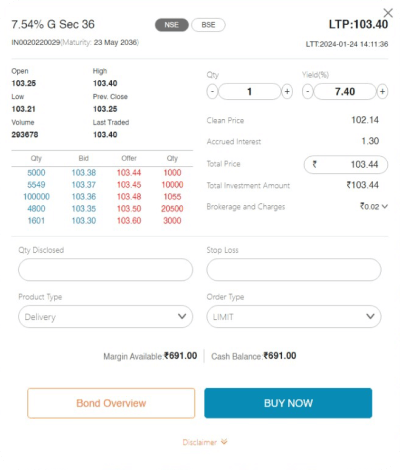

Buy

Buy Securities Transparently at live market rates within seconds.Compare rates across (NSE,BSE,RFQ)

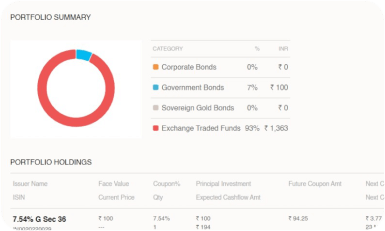

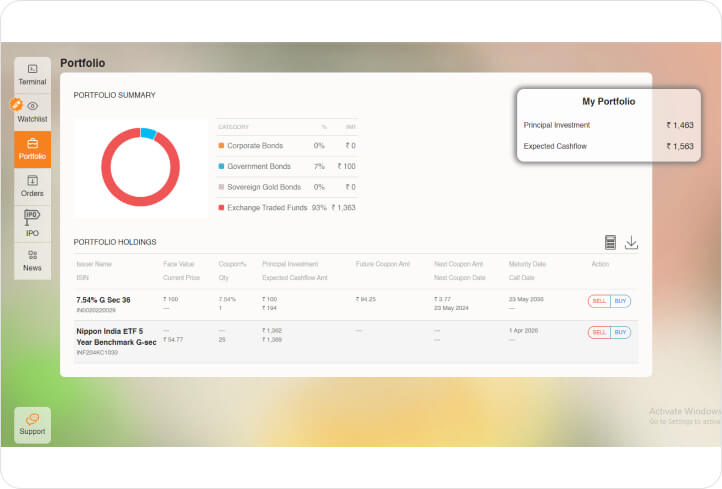

Portfolio

Get a comprehensive understanding of your portfolio’s summary at any moment.Use analytics to modily your investments.

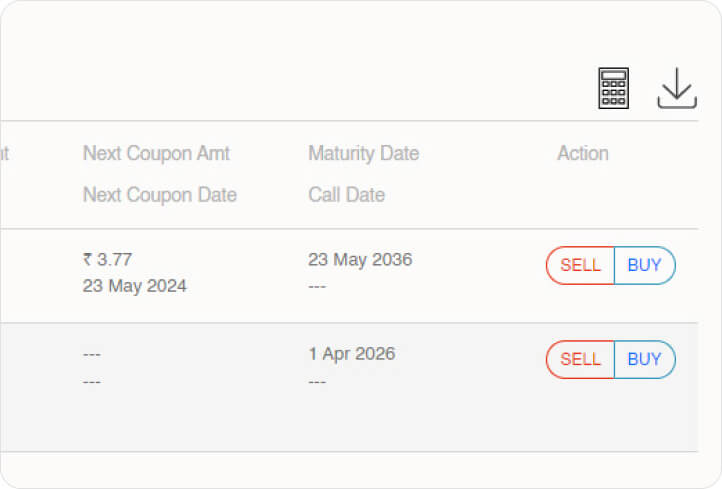

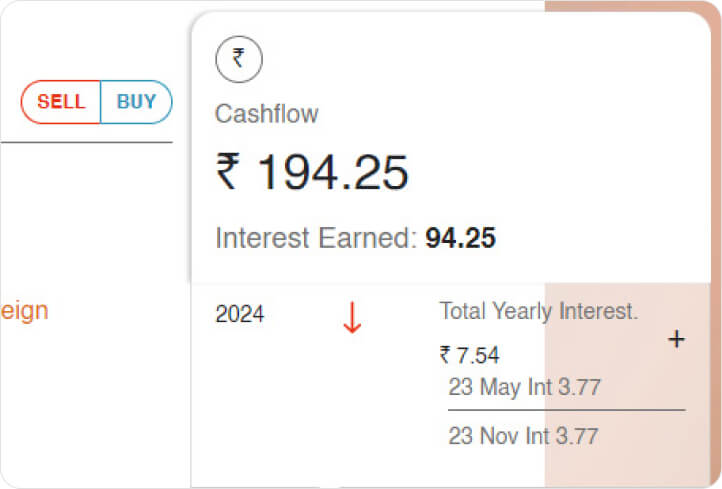

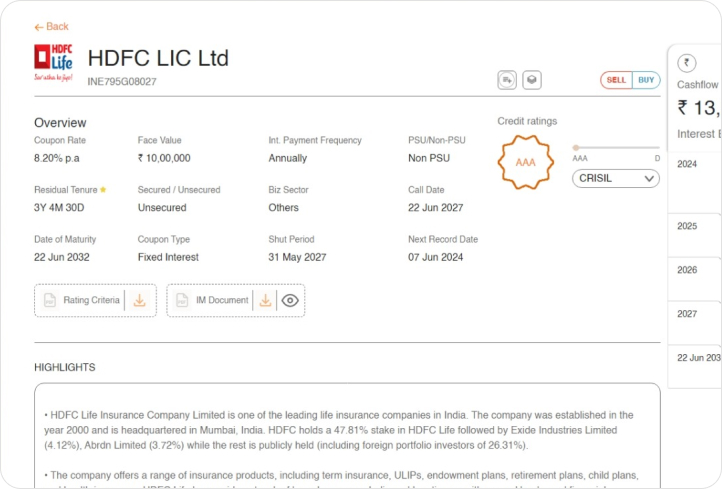

Bond Info

Get detailed information on variety of security such as Face value, Coupon rate, Date of Maturity, Remaining tenure, Interest payment frequency, credit ratings, Highlights and Key Features of the bond.

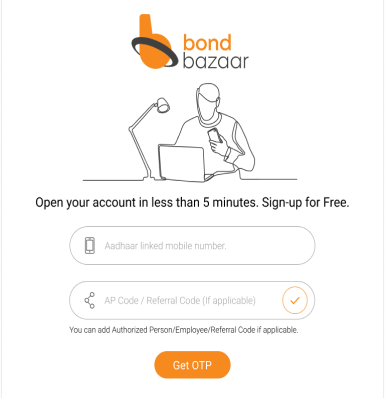

Account Opening Process

-

Enter your Aadhar registered mobile number and provide the OTP

Enter your Aadhar registered mobile number and provide the OTP -

Fill your basic details - PAN, Aadhar, Bank Details, Signature and Complete the registration process.

Fill your basic details - PAN, Aadhar, Bank Details, Signature and Complete the registration process. -

You will receive your Login ID and password within 48 hours of registration via SMS and email.

You will receive your Login ID and password within 48 hours of registration via SMS and email. -

You will be prompted to change your password to a desired password on your first login

You will be prompted to change your password to a desired password on your first login

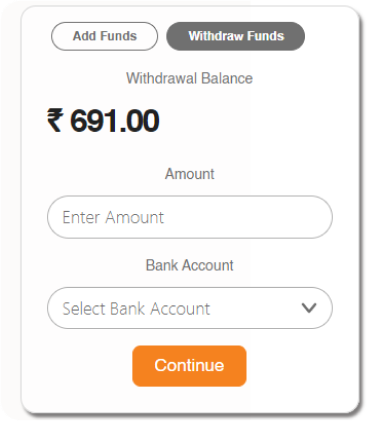

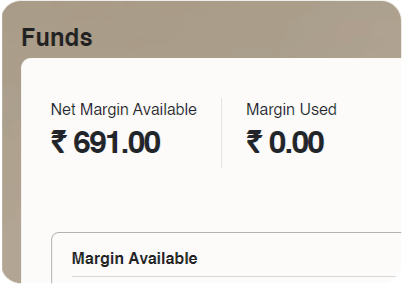

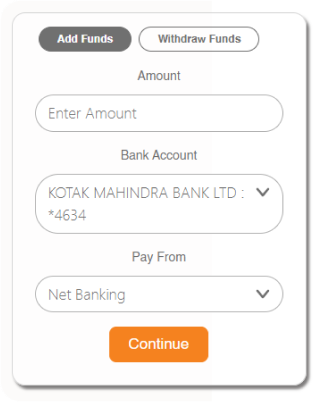

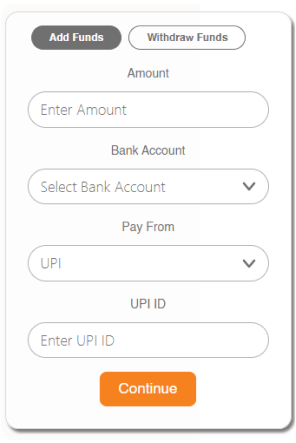

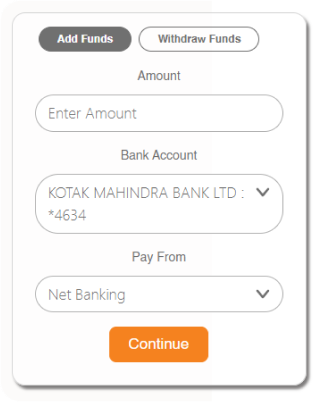

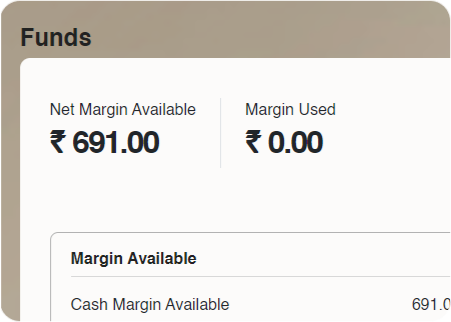

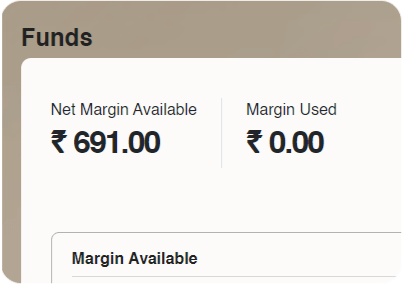

Add / Withdraw Funds

Buy / Sell Bonds

-

Make sure you have funds added into your trading account

Make sure you have funds added into your trading account -

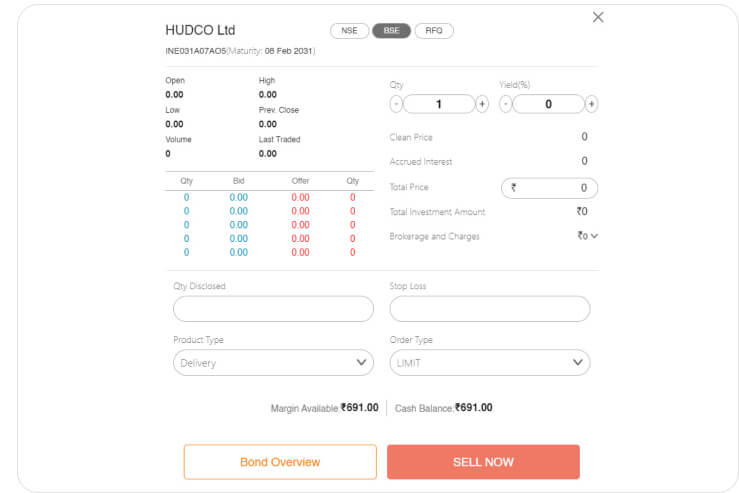

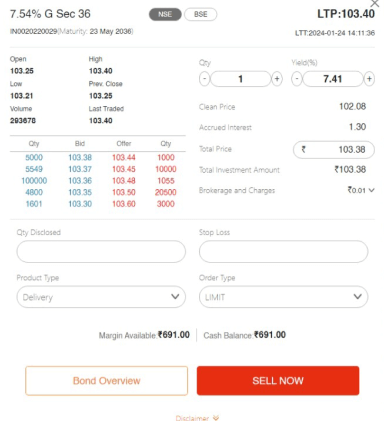

Select bond of your choice and click on Buy

Select bond of your choice and click on Buy -

Enter quantity, check final price then click on buy now

Enter quantity, check final price then click on buy now -

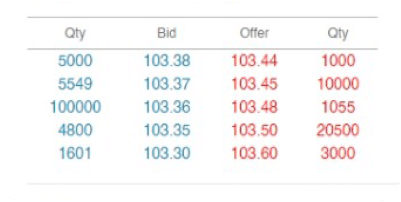

Market Depth Gives You Insights Into Market Transactions

Market Depth Gives You Insights Into Market Transactions -

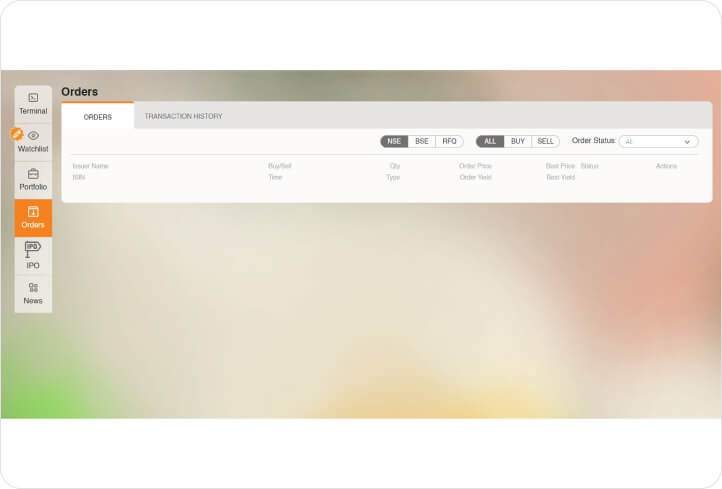

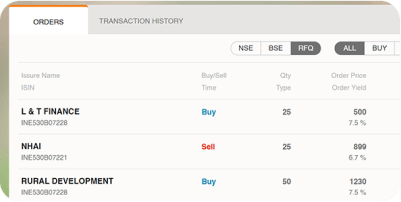

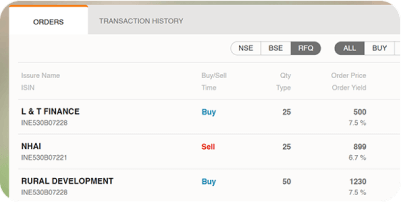

Bond Appears in Orders then moves to portfolio

Bond Appears in Orders then moves to portfolio

Apply for IPO

-

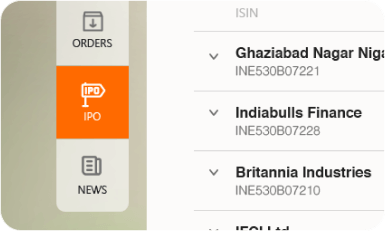

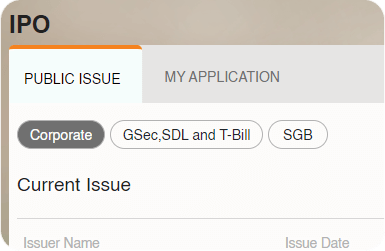

Click on the IPO section

Click on the IPO section -

Toggle between Corporate, Government & Gold Bonds

Toggle between Corporate, Government & Gold Bonds -

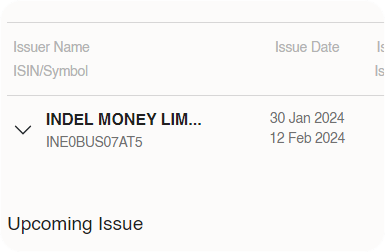

Click on the arrow to choose from available IPOs

Click on the arrow to choose from available IPOs -

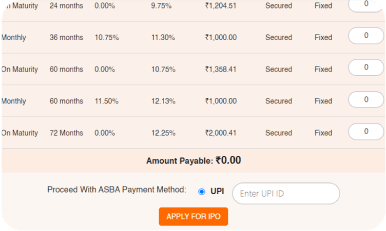

Enter investment value and click on apply

Enter investment value and click on apply