The Key to a Stable Portfolio

Long-Duration Bonds

Just because you have a sudden cash inflow does not mean you have to put it at risk. Bonds are a powerful tool for capital protection. For example, you may want to buy a car in 12-18 months or maintain an emergency fund. You can always keep that money in bonds. That is the point where long-term bonds come into play.

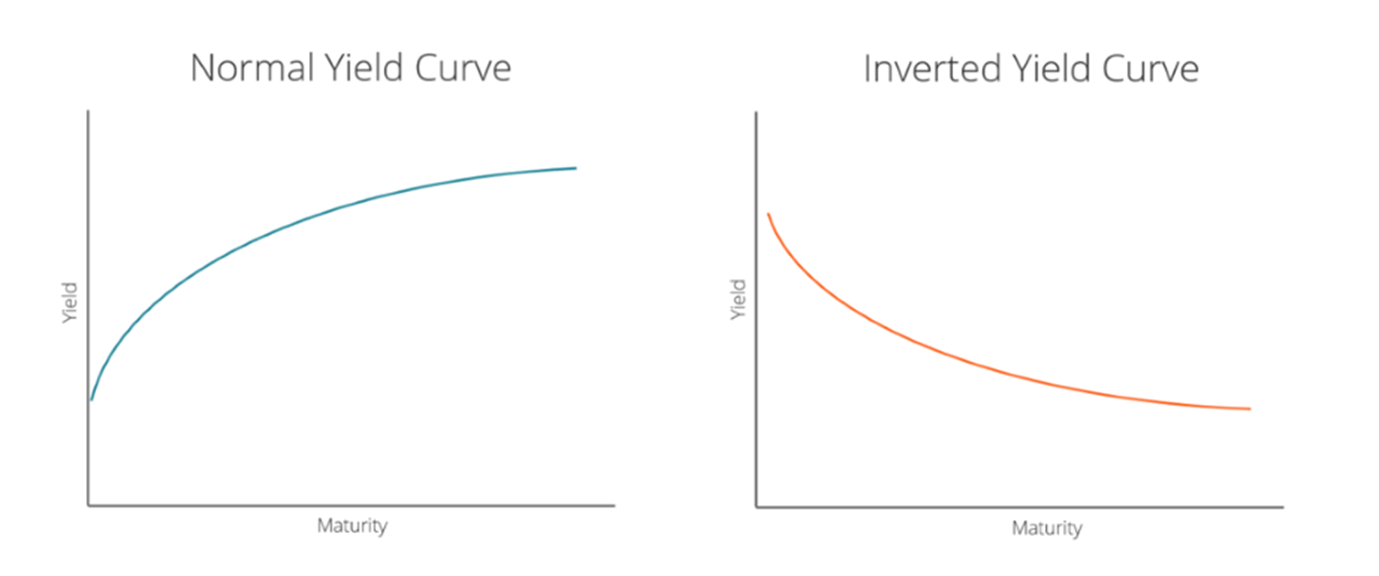

Understanding the yield curve

To understand playing long-term bonds, you must first know the concept of the yield curve. It is a chart that shows the interest rate on short-term, intermediate, and long-term bonds. These are typically treasury bonds issued by the government.

A 'normal' yield curve is steeper at the beginning and flattens in the long term. That means short-term interest rates are lower than long-term rates. So, as a bond investor, you get compensated for the long-term risk you take with a higher interest rate.

An 'inverted' yield curve is when short-term interest rates are higher than long-term interest rates. As a bond investor, you get a higher short-term return if the perceived risk to your capital is higher than that in the long term.

(WE HAVE PUT THIS IMAGE FOR EXPLANATION ONLY. PLEASE DO NOT USE THIS IMAGE ON YOUR WEBSITE. YOU WILL HAVE TO INSERT SOMETHING THAT IS COPYRIGHT-FREE MATERIAL)

The yield curve is a proxy for the economy's direction and the interest rates you pay. The risk in the economy is reflected in the yield. It rises when investors' risk perception is high and falls when it is low. When economic expansion is about to begin, the normal yield curve becomes steep. That is because, at that stage, interest rates are low to give a boost to the economy. As the demand for money increases, it has an inflationary impact on the economy. If the perception of the inflation risk in the long term grows, you could lock yourself at lower rates today. So, that results in a steep curve where long-term rates go higher. When the direction of the yield curve takes a sudden turn, it is a sign that the economic outlook is changing. When central banks hike interest rates to tame inflation, there is a point at which markets look for signals that indicate the end of the rising interest rates. That signal could be a sharp drop in consumer and wholesale prices. Then, it would be the commentary of the monetary policy committee on the inflation outlook. If it turns dovish, where the inflation expectations are lower, the curve begins to flatten. It will stay flat until low inflation induces a recession or an economic slowdown.

Then, the market will look for a signal from the central banks to lower borrowing rates. When the monetary policy committee that sets interest rates talks about lower economic growth and inflation, the markets pick up a signal and expect interest rates to fall. The inverted yield curve begins to take effect as a result.

How to play long-term bonds

There are two ways you can earn money with this strategy. One is through the interest earned on the bond's coupon. The second is through capital gains.

For example, if you invest in a bond with a par value of 850 rupees. It has a maturity period of 10 years and a coupon rate of 5%. You can expect a current yield of 6.8% and a yield to maturity of 9.15%, according to this bond yield calculator [AJB1]

If you hold on to this bond till maturity, no matter the price in the secondary market of the bond, you will get that return. Since we are talking about government bonds, there is a zero-credit risk. The interest is guaranteed by the sovereign, making it the safest security.

The other opportunity arises if interest rates are likely to go down. Your knowledge or understanding of the yield curve will make a difference.

In a high-growth economy, the long-term trajectory of interest rates is lower. That is a natural progression. There is a surge in high-yield bond prices in the secondary market at the hint of a decline in the interest rates. You can sell this high-yielding bond and buy a cheaper bond with a lower yield. If interest rates fall further, you can repeat that exercise. If interest rates rise, you must ride through the fall in secondary market prices and not rush to sell. You must wait for the subsequent decline or hold on to the bond till maturity. Selling it before maturity would lead to a capital loss.

It is possible to determine how much you stand to gain by investing in bonds of various maturities. Your profit will depend on the entry and exit points you take while offloading and taking on new investments in bonds. Predicting the peak or bottom of the interest rate cycle is not easy.

With all eyes now on the global economic narrative around constant rate hikes and a sustained eagerness to push for a post-covid economic recovery, it will be an exciting and potentially profitable time to dive into the Indian bond market. There is a good chance that the top of the interest rate cycle is nearby.

Liked what you read? Share this article with your followers.

Sign up and follow us on and to get the best stories on Investments, Strategies, Tools, Ideas & Insights to help you Grow and Conserve your wealth.